The U.S. stock market finds itself at a critical juncture, shaped by a complex interplay of economic indicators, investor sentiment, and geopolitical events. The performance of the stock market, particularly the S&P 500, which serves as a barometer for the overall health of the economy, has been marked by significant volatility and fluctuations, reflecting both the resilience and the challenges faced by investors. Today we try to provide an analysis of the U.S. stock market performance in 2024, delving into the underlying factors driving market movements, the implications of Federal Reserve policies, and the broader economic landscape.

Market Overview and Key Indicators

In the early months of 2024, the stock market exhibited a robust performance, buoyed by a combination of strong corporate earnings, a resilient economy, and a renewed interest in technology stocks, particularly those associated with artificial intelligence (AI). The S&P 500 index, which encapsulates the performance of 500 of the largest publicly traded companies in the U.S., recorded impressive gains, reflecting a positive investor outlook. As of mid-September, the index had surged approximately 17.93% since the beginning of the year, showcasing the market's ability to rebound from previous downturns and capitalize on favorable economic conditions.

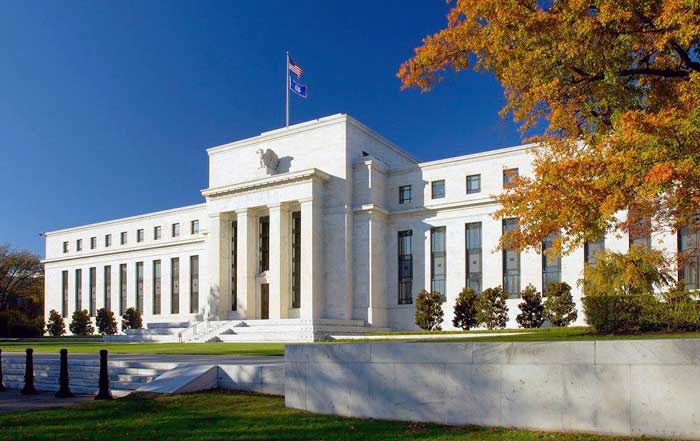

However, this upward trajectory has not been devoid of challenges. The Federal Reserve's monetary policy remains a significant influence on market dynamics, as interest rate decisions play a critical role in shaping investor behavior and corporate profitability. Throughout 2023, the Fed implemented a series of interest rate hikes aimed at curbing inflation, which had reached its zenith in the previous year. As inflationary pressures began to ease, speculation surrounding potential rate cuts gained traction, leading to heightened volatility in the stock market as investors recalibrated their expectations.

Federal Reserve's Influence on Market Dynamics

The Federal Reserve's decisions regarding interest rates have historically been pivotal in determining the course of the stock market. In 2024, the central bank's approach to monetary policy is characterized by a cautious stance, with indications that it may pivot towards a more accommodative policy as inflation continues to moderate. Analysts anticipate that the Fed may implement one or two rate cuts throughout the year, a shift that could provide a much-needed catalyst for further market gains.

The implications of these potential rate cuts are profound, as lower interest rates generally translate to reduced borrowing costs for businesses and consumers alike. This environment fosters increased investment in growth-oriented sectors, particularly technology, which has been a significant driver of market performance in recent years. The so-called "Magnificent Seven" stocks, which include industry giants such as Apple, Microsoft, and Nvidia, have been instrumental in propelling the S&P 500 to new heights, accounting for a substantial portion of the index's gains.

Nevertheless, the market's reliance on a handful of large-cap stocks raises concerns about the sustainability of this rally. Analysts caution that a more diversified market participation is essential for long-term stability, as excessive concentration in a few stocks can lead to increased volatility and potential downturns. The need for broader participation across various sectors is underscored by the observation that less than one-third of S&P 500 constituents outperformed the broader index in the previous year, highlighting the risks associated with an overreliance on a select group of companies.

Economic Growth and Corporate Earnings

The U.S. economy has demonstrated resilience in the face of various challenges, including elevated inflation and geopolitical tensions. Economic growth, while slowing compared to the previous year, remains robust enough to support corporate profitability. Analysts project that S&P 500 companies will continue to report steady earnings growth, with expectations of a 5.4% increase in the third quarter and a more substantial 15.7% growth in the fourth quarter. This positive outlook is bolstered by strong consumer spending, which has remained resilient despite rising interest rates and inflationary pressures.

However, the economic landscape is not without its headwinds. The ongoing geopolitical tensions, particularly in regions such as Ukraine and the Middle East, have the potential to disrupt global supply chains and impact energy prices, creating uncertainty for investors. Moreover, concerns regarding a potential recession loom large, as the Federal Reserve's aggressive rate hikes in previous years continue to exert pressure on economic growth. While the consensus among economists is that a recession is unlikely in the immediate future, the possibility of a slowdown cannot be dismissed.

U.S. Stock Market Performance 2024

Investor Sentiment and Market Volatility

Investor sentiment plays a crucial role in shaping market dynamics, and 2024 has seen its fair share of volatility driven by shifting perceptions. The early months of the year were characterized by optimism, as investors responded positively to strong corporate earnings and the potential for rate cuts. However, as the year progressed, concerns over elevated valuations and the concentration of gains among a select group of stocks began to weigh on sentiment.

The market's performance has also been influenced by external factors, including inflation data and economic indicators. For instance, the release of inflation reports has historically triggered significant market movements, as investors react to changes in the economic landscape. In August, the tech-heavy Nasdaq composite experienced a notable decline, driven by disappointing earnings reports from several major technology companies and concerns over inflated valuations in the AI sector. This sell-off served as a reminder of the inherent risks associated with investing in high-growth stocks, particularly in an environment characterized by rising interest rates.

Despite these challenges, many analysts remain optimistic about the market's prospects for the remainder of the year. The historical performance of the stock market during presidential election years suggests that investors can expect solid gains, as the S&P 500 has averaged a 7% increase during such periods since 1952. This trend, coupled with the potential for rate cuts and continued corporate earnings growth, provides a favorable backdrop for investors looking to navigate the market in 2024.

Sector Performance and Future Outlook

As the market evolves, different sectors exhibit varying degrees of performance, reflecting the underlying economic conditions and investor preferences. In 2024, the technology sector has emerged as a key driver of market gains, fueled by the growing demand for AI technologies and digital transformation initiatives across industries. However, the concentration of returns in a handful of large-cap tech stocks raises concerns about the sustainability of this trend, as investors increasingly seek diversification and exposure to other sectors.

The financial sector has also shown resilience, benefiting from rising interest rates that enhance profit margins for banks and financial institutions. As the Fed signals a potential shift towards rate cuts, the outlook for financial stocks may become more uncertain, prompting investors to reassess their positions. Conversely, the consumer discretionary and communication services sectors have demonstrated strong performance, driven by robust consumer spending and increased demand for digital services.

Looking ahead, analysts expect the stock market to continue its upward trajectory, albeit at a more moderate pace compared to the previous year. The anticipated rate cuts by the Federal Reserve, coupled with steady corporate earnings growth, create a conducive environment for equity markets. However, investors must remain vigilant and consider potential risks, including geopolitical tensions, inflationary pressures, and the possibility of a slowdown in economic growth.

In conclusion, the U.S. stock market performance in 2024 is characterized by a delicate balance of optimism and caution, as investors navigate a complex landscape shaped by economic indicators, Federal Reserve policies, and geopolitical events. While the potential for further gains exists, the need for diversification and a broader market participation remains paramount to ensure sustained growth and stability in the years to come. As the market continues to evolve, staying informed and adaptable will be crucial for investors seeking to capitalize on opportunities while mitigating risks in this dynamic environment.